Cadres de données pour vous aider à naviguer dans votre démarche de finance durable

Centre de ressources – Cadres ou principes

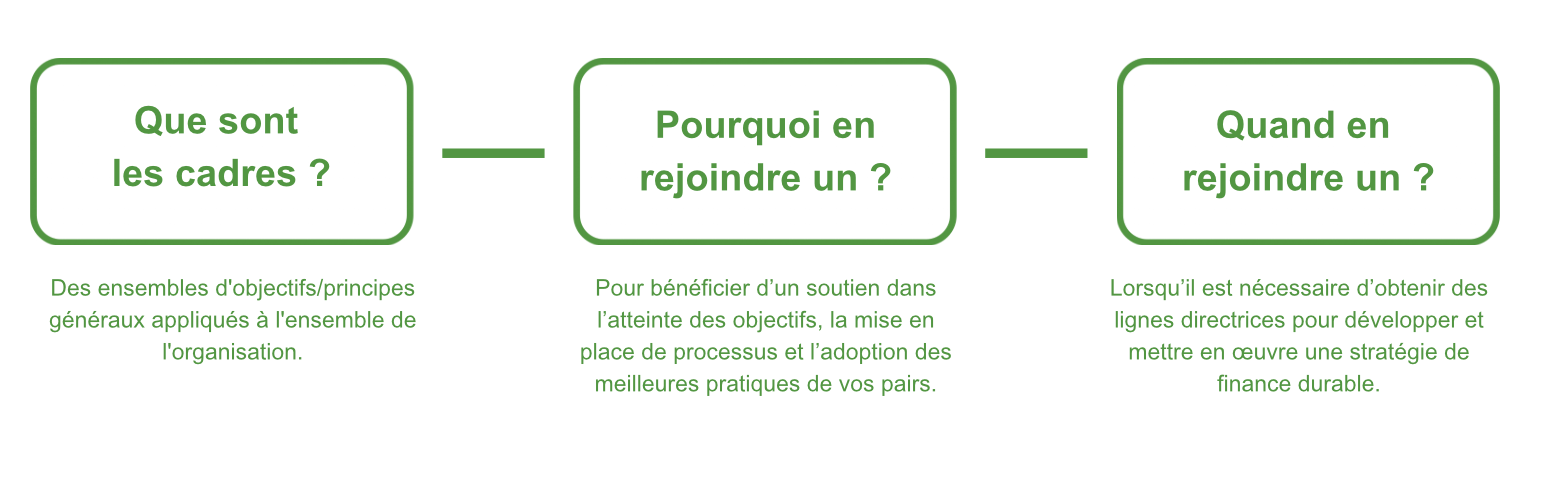

Explorez les principaux cadres ou principes qui guident les professionnels de la finance. L’image ci-dessous donne un aperçu de ces plateformes, expliquant ce qu’elles sont, ainsi que quand et pourquoi les utiliser. Le tableau ci-dessous donne un aperçu des principaux cadres pertinents pour ce domaine. Vous pouvez filtrer par public cible, thèmes, ou effectuer une recherche directe avec des mots-clés. Pour une meilleure expérience, nous recommandons d’ouvrir cette page sur un ordinateur portable et de la visualiser en mode plein écran.

Trouver un cadre

| wdt_ID | Name | Description | Targets | Themes | Members / AUM JUNE2024 | Members / AUM FEB2025 |

|---|---|---|---|---|---|---|

| 1 | A Legal Framework For Impact | Analyse how investors can manage their fiduciary and sustainability impact duties and what happens if they are in conflict. | Investors | Impact Investing, Sustainable Finance | 539 / NA | NA |

| 2 | Asset Owner Diversity Charter | Formalise a set of actions to improve diversity, in all forms, across the investment industry. | Asset Owners | Diversity & Inclusion | 26 / £1 tn | 108+ / £13+ tn |

| 3 | Finance for Peace | Catalyse a market for peace-positive investment. Work to create standards, market intelligence and partnerships across sectors to build trust, share knowledge and establish networks. | Financial Institutions, Institutional Investors, Investors | Diversity & Inclusion, Human Rights, Peace, Social | / | / |

| 4 | Integrated National Financing Framework | Plan and deliver tool to help countries strengthen planning processes and overcome obstacles to financing sustainable development and the SDGs at the national level. | States | SDGs | / | / |

| 5 | Climate Target Setting for Banks | Underpin the setting of credible, robust, impactful and ambitious targets in line with achieving net zero by 2050 greenhouse gas emissions goals. | Banks | Net-zero Emissions, SDGs | / | / |

| 6 | Nature Target Setting Framework | Empower investors to set ambitious nature targets and introduce new elements to help financial institutions align their investments with nature targets, reinforcing the need to halt and reverse biodiversity loss. | Asset Managers, Asset Owners, Financial Institutions | Biodiversity, Climate Transition, Ecosystem, Environment, Sustainable Finance | / | 82 / NA |

| 7 | Biodiversity Footprint for Financial Institutions (BFFI) | An impact assessment approach developed to enable financial institutions integrate biodiversity impact into their investment decisions. | Financial Institutions | Biodiversity, Ecosystem, Environment | NA | NA |

| 8 | CDSB framework for reporting environmental and climate change information | Approach for reporting environmental and climate change information in mainstream reports, such as annual reports, 10-K filing, or integrated reports. | Companies, Financial Institutions | Accounting, Climate Disclosure, Environment | NA | NA |

| 9 | Equator Principles (EPs) | Minimum requirements to determine, assess and manage environmental and social risks in projects financing. | Financial Institutions, Infrastructures, Project Finance | Environment Risk, Social Risk | 128 / NA | 129 / NA |

| 10 | European Microfinance Platform | Assess the environmental performance of financial services providers and other stakeholders in green inclusive finance and defines action plans to improve. | Academia, Financial Institutions | Microfinance | 95 / NA | 120 / NA |

Avertissement – Veuillez noter que la LSFI est une association à but non lucratif visant à soutenir le développement de la finance durable. Le contenu du site web de la LSFI a pour objectif de servir cette mission en fournissant des informations permettant à son audience de mieux comprendre et appréhender les concepts et acteurs de la finance durable. Ce travail ne prétend ni être exhaustif ni favoriser une organisation plutôt qu’une autre. Il ne doit en aucun cas être considéré comme un conseil financier ou juridique.