Private Investors & Savers

Survey on Sustainable Finance in Luxembourg 2022

Overview of the interest, knowledge and concerns of Luxembourg residents regarding sustainable finance.

Sustainable finance refers to financial decisions that not only seek financial return, but also consider its non-financial impact and the environmental, social governance aspects.

The regulatory agenda and the climate emergency have put the spotlight on professional investors.

However, the general public can also play an important role through their investment choices and savings.

In this context, the CSSF, the Foundation ABBL for Financial Education and the LSFI have launched a survey to assess the level of knowledge and understanding of the general public on sustainable finance, as well as their interest and the best way to approach them to engage in this path.

Results in detail

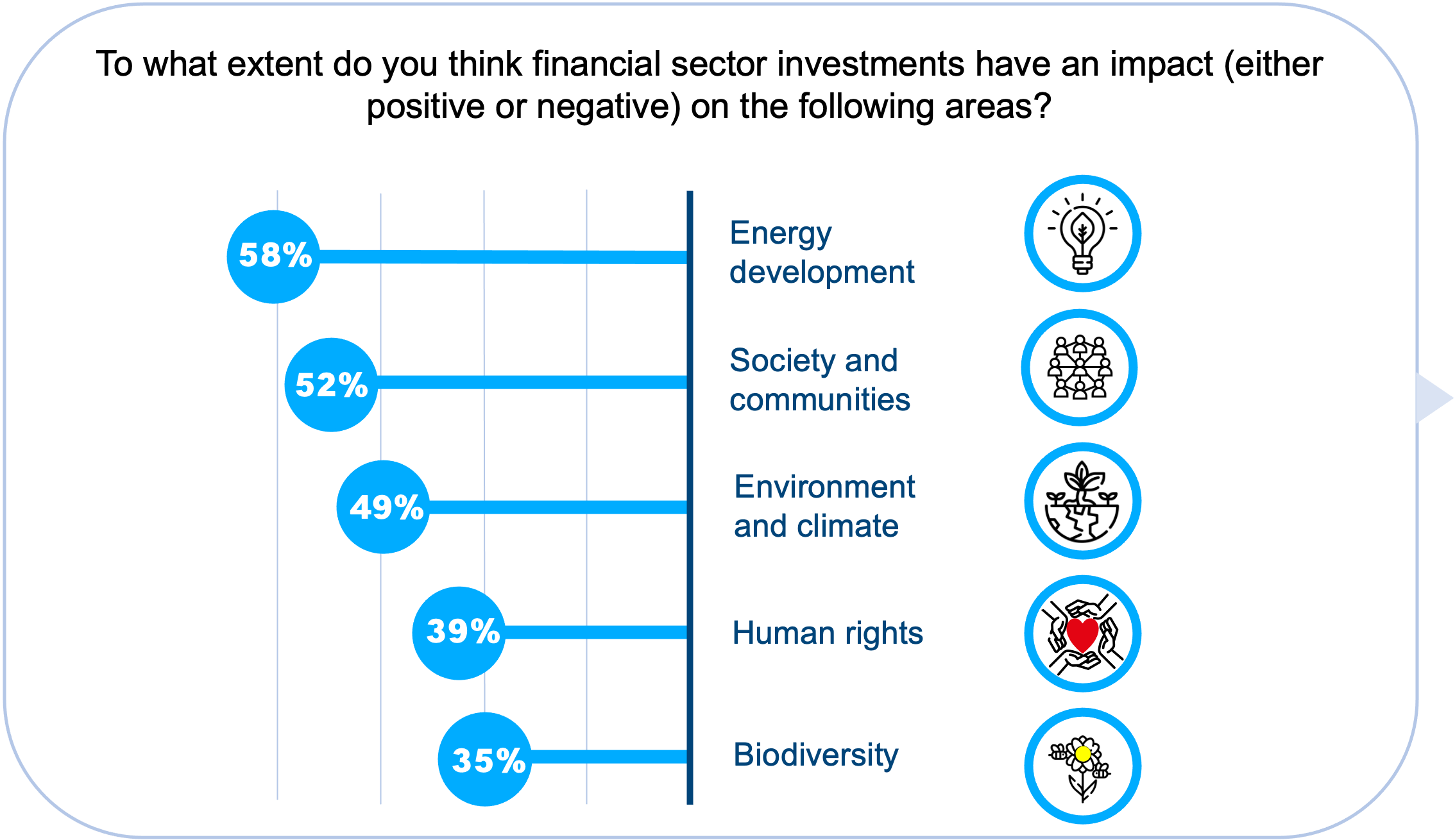

1 – Perception of the impact of sustainable finance

Positive impact of the financial sector on the environmental, social and governance factors

The survey highlighted that the majority of respondents believe that the financial sector plays an important role in the transition of our economies towards more sustainability and can have a positive impact for example (but not only) on the development of renewable energies, local communities or the environment and climate.

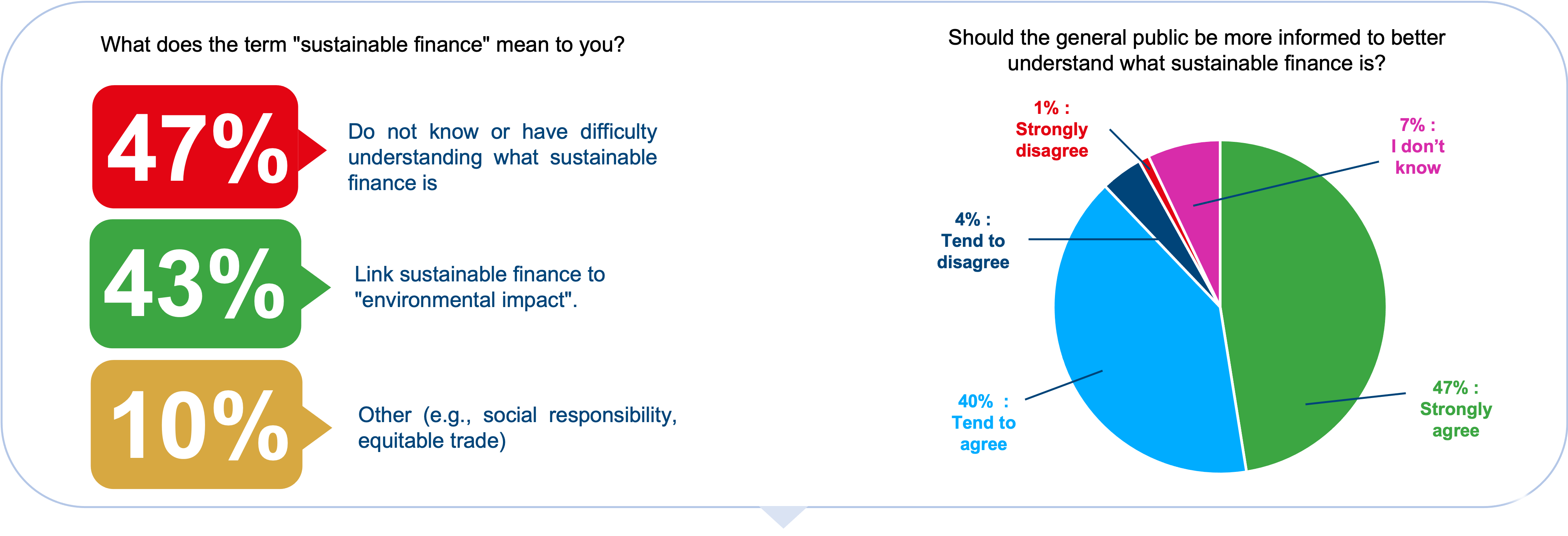

2 – Understanding and need of information:

General lack of knowledge

Generally speaking, sustainable finance is a subject that the general public has difficulty understanding: 47% of respondents admit that they do not know or have little knowledge of what it is. Moreover, 43% of those surveyed associate sustainable finance with « environmental impact ». The other dimensions (social and governance) are not well known.

Need for transparency

For the respondents, transparency and the need to be better informed are key factors in overcoming the lack of knowledge and understanding of the subject of sustainable finance.

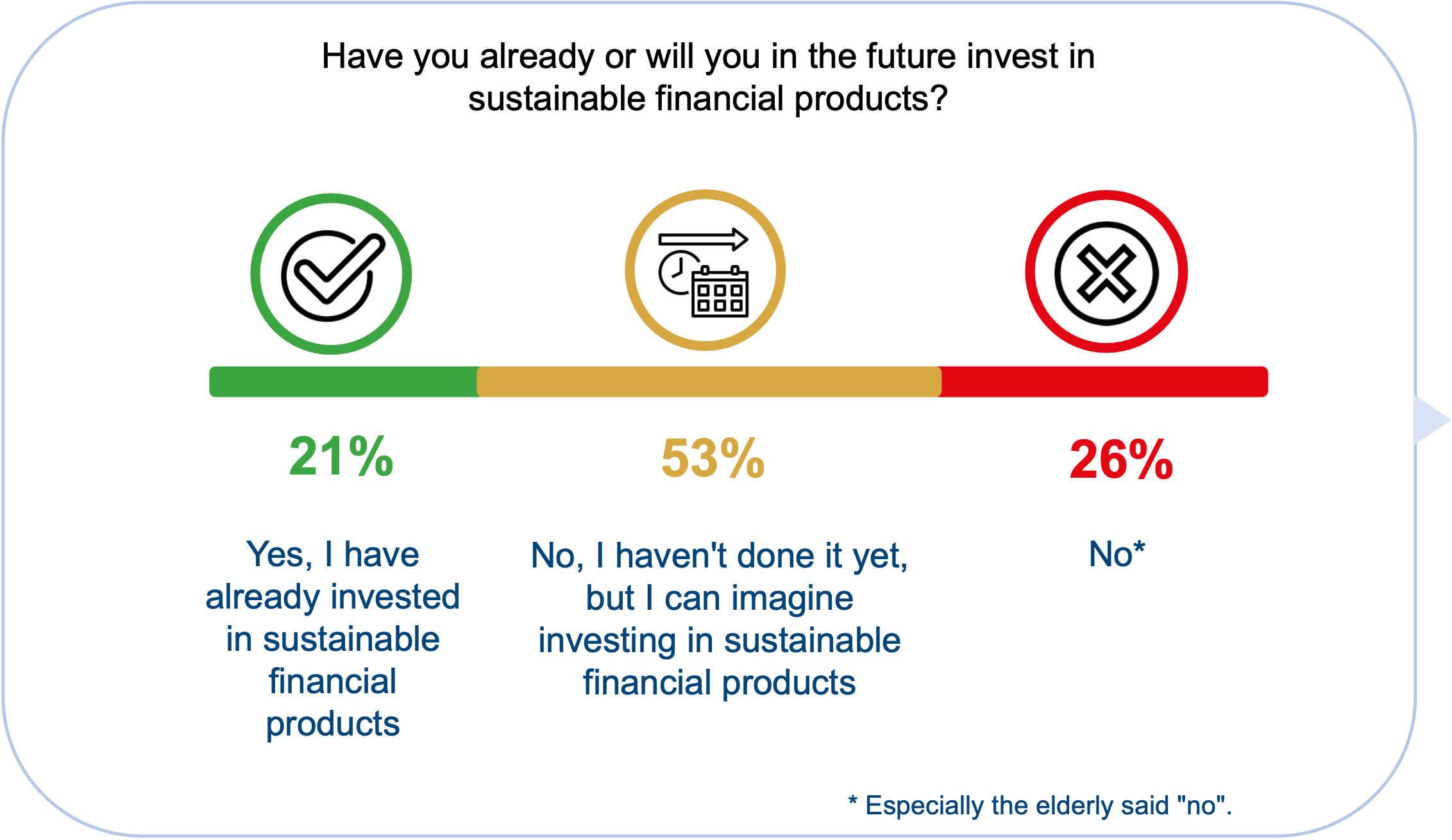

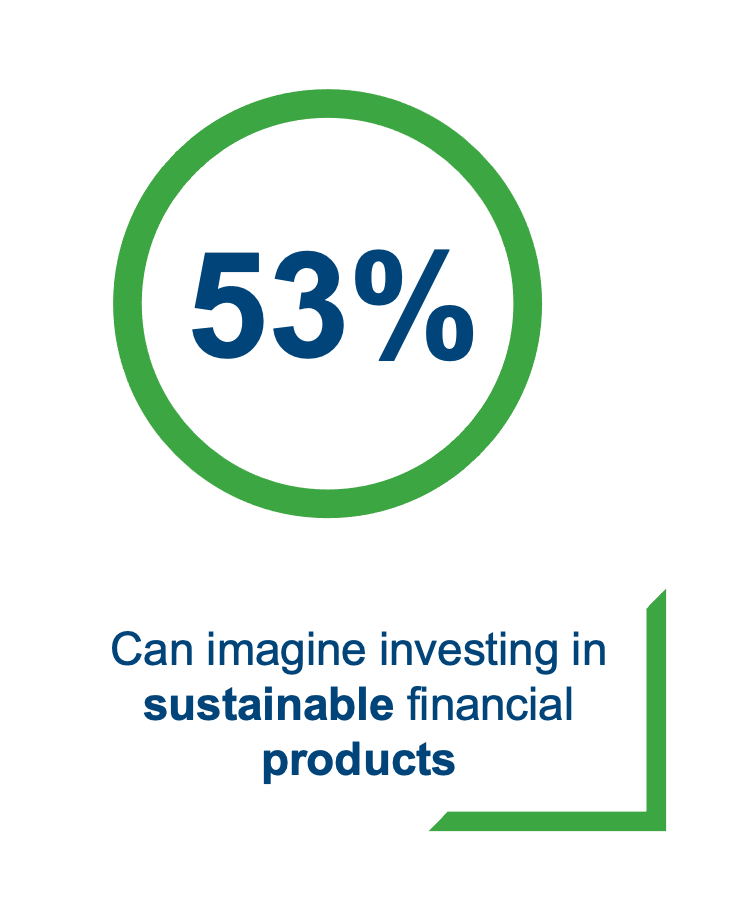

3 – Investment and information level in sustainable finance products:

Strong interest in sustainable finance products

The general public is clearly interested in financial products related to sustainable finance and the potential ofinvestment in these products is high.

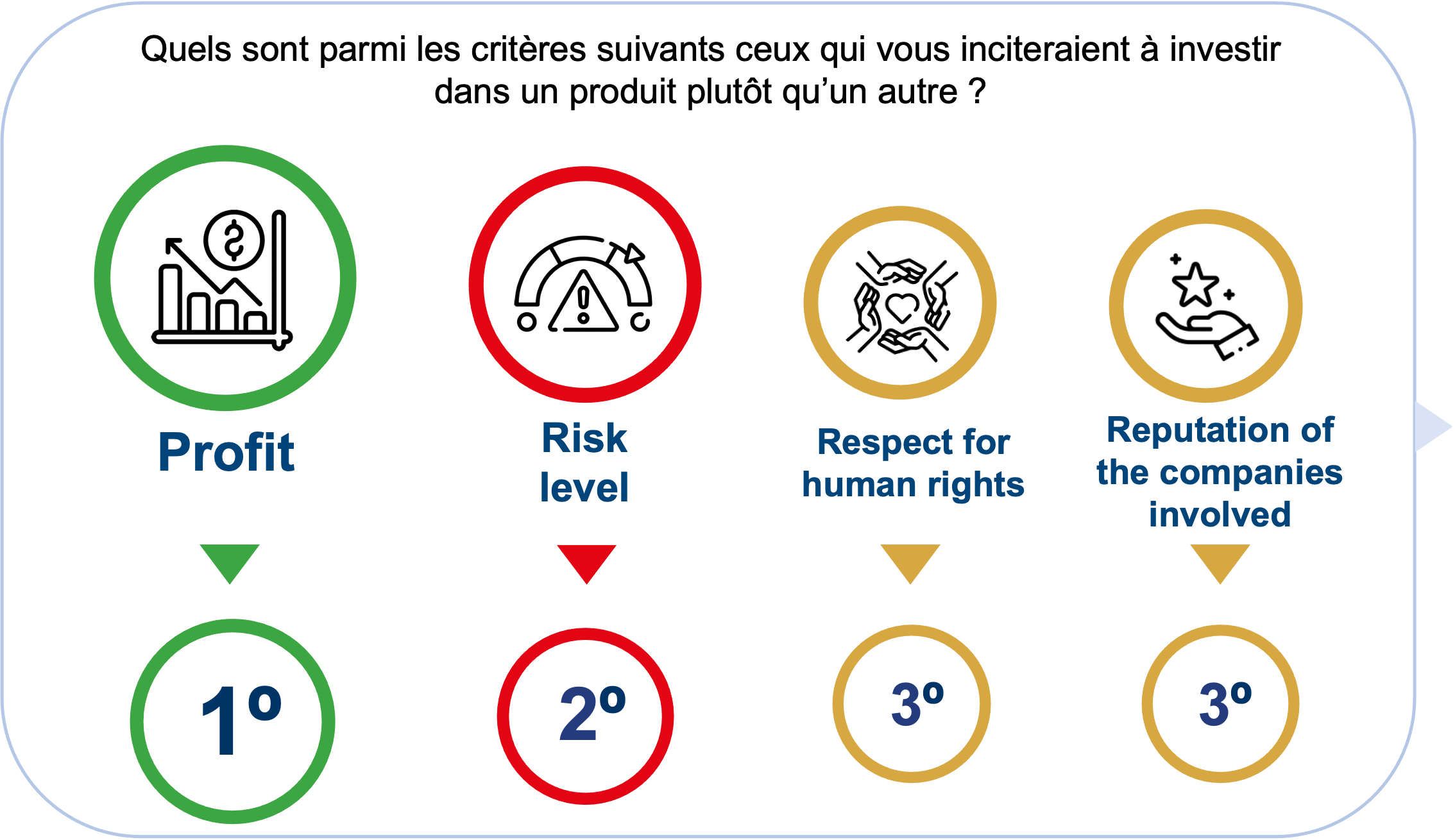

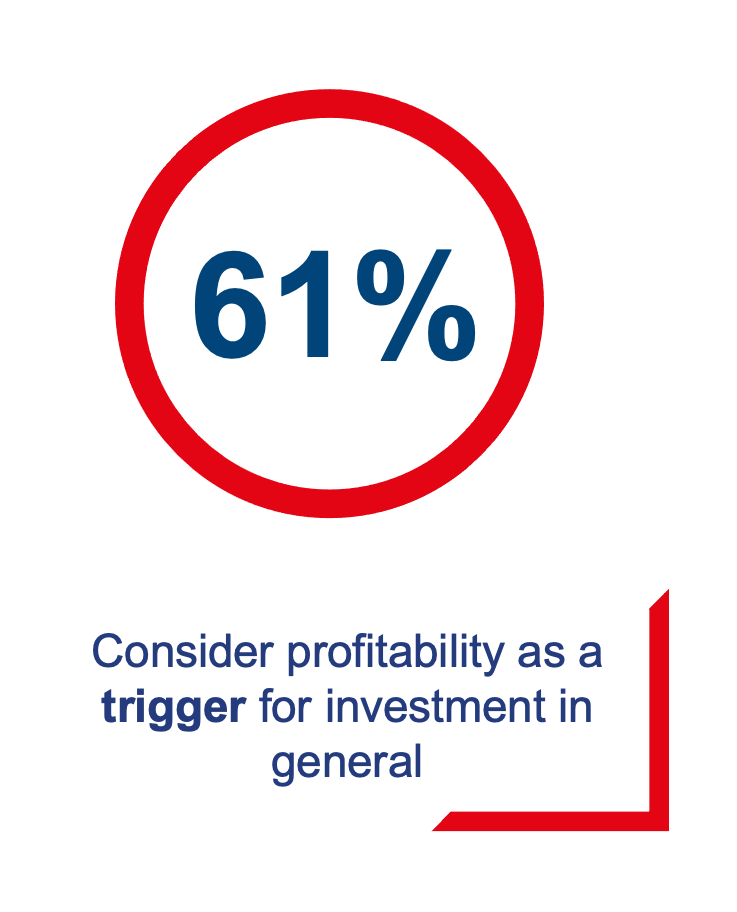

4 – Profit and risk: investment triggers:

Profit and risk : key selection criteria for investment decisions

Profit and risk level remain the key drivers of an investment decision: respondents say that the top 3 drivers of an investment are first profitability, second the level of risk and third (equally) the reputation of the companies involved and the respect of human rights.

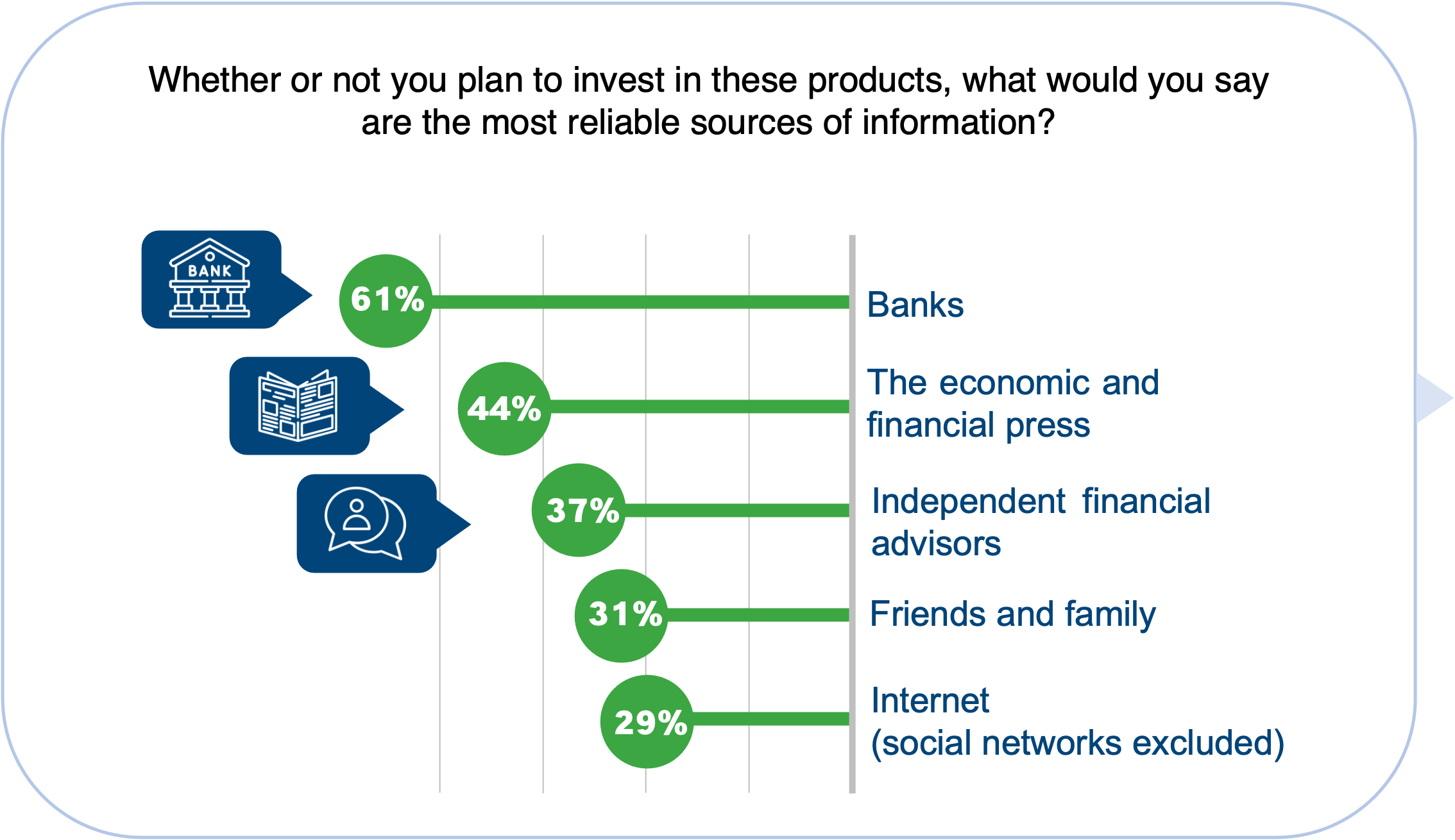

5 – The role of the banker:

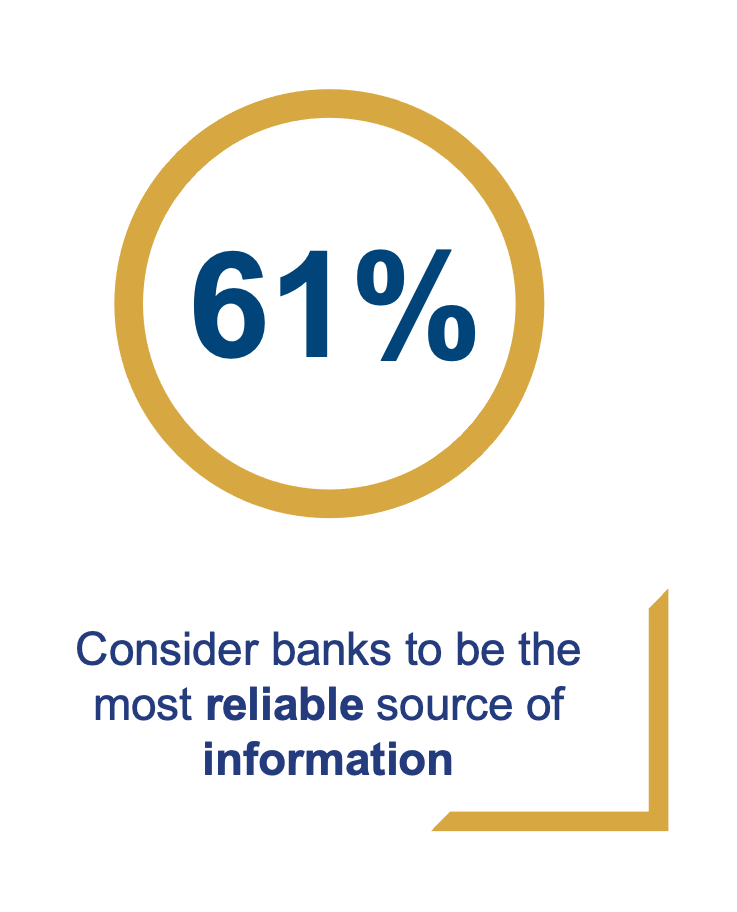

Le banquier comme source d’information la plus fiable

The banker as the most reliable source of information. The survey reflects the trust and expertise given to the banker.

Key figures

Next steps

In the coming months, the LSFI will focus and intensify its activities towards private investors and savers. A dedicated section on the LSFI website will be launched to provide them with knowledge, tools and practical advice to invest in a sustainable way. Furthermore, the LSFI will continue to offer sessions to raise awareness and inform the general public so that sustainable finance reaches as many people as possible, and everyone can contribute to face the challenges our society has to deal with today.

ABBL, in cooperation with the CSSF, is committed to initiate an awareness and information campaign on sustainable finance to reach the general public.

The ABBL has already set up training courses in sustainable finance to train bank advisors;

In terms of financial education, the ABBL through its Foundation for Financial Education continues its awareness raising activities among the general public, namely:

- Offering workshops on responsible finance to all high school students in Luxembourg;

- Distributing information brochures and videos to the general public.

The Foundation will broaden its range of educational tools in the field of financial education (including responsible finance) by making available to all, and to schools, a financial education game in the form of an interactive mobile application to raise awareness and understand the world of finance while having fun.

The CSSF, through its Letzfin initiative, will continue its actions in the field of the general financial education and will intensify those more specifically related to sustainable finance, in different ways:

- It will continue to expand the sustainable finance section of its website www.letzfin.lu.

- It will do the same through its presence on social networks – Facebook and Instagram – and on Youtube, by publishing animations on sustainable finance.

- It will establish partnerships with mainstream media groups.

In all the messages it issues, it will contribute to turn consumers into actors, to enable them to ask themselves the right questions before investing in a sustainable finance product.

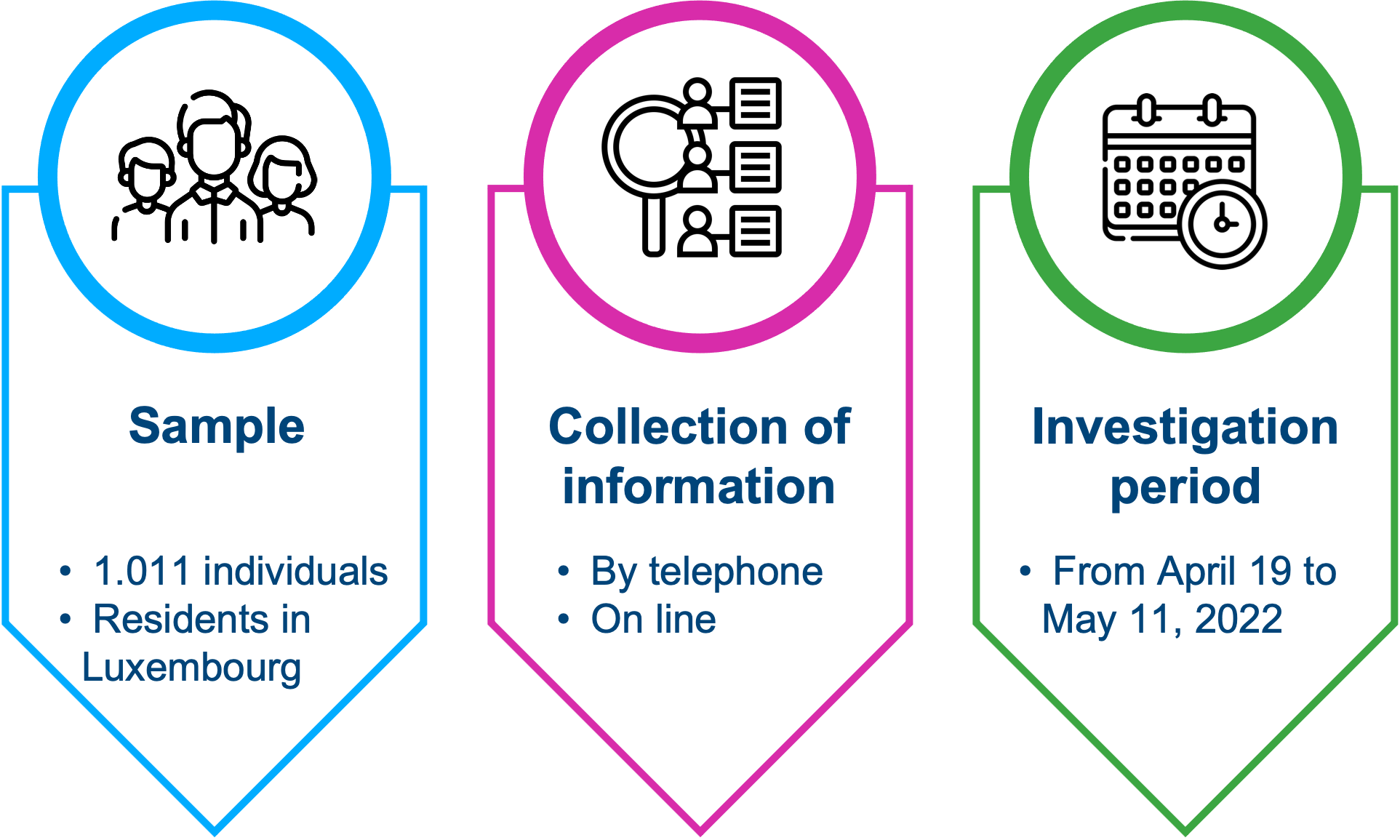

Methodology

The survey was conducted by ILRES among a representative sample of 1011 people residing in Luxembourg, from mid-April to mid-May 2022. Half of the interviews were conducted by telephone and half online.