What are Nature-based Solutions?

Trees are often planted for water supply, erosion prevention or shade. In this way, nature is being used to provide solutions to people’s needs in ways that are both efficient and harmless to their surroundings, thus representing Nature-based Solutions (NbS). NbS generally form part of efforts to address societal challenges through the sustainable use (protection, management, restoration) of ecosystems in ways that provide both human well-being and biodiversity benefits.

While nature can deliver more than 20% of climate change mitigation goals, sustainable land-use sectors are still underfunded. A recent study by United Nations Environment Programme, WEF, ELD, and Vivid Economics highlights that the financing gap for nature will be USD 4.1 trillion by 2050, with only 14% of the resources currently available coming from private capital. This financing gap may be linked to the lack of understanding of the economic importance of NbS, both on the risks and return sides. NbS are often cost-efficient ways of mitigating climate risks such as floods, drought and fires. Green infrastructures in cities are good examples of how NbS offer low-cost opportunities for urban environments. Furthermore, they also represent opportunities for bankable business models, in the sustainable forestry and agriculture, tourism and water sectors among others. With the demand for green zero-deforestation commodities and the need for areas with high recreational and landscape values increasing, it appears very clearly that NbS and sustainable value chains go hand-in-hand.

What is the role of the financial sector in mainstreaming Nature-based Solutions?

The finance sector has a big role to play to direct financing flows towards NbS. This includes several actions, in particular:

- screening out and disclosing the risks posed by biodiversity loss and climate change on investments, and the way around the risks and impacts that planned projects have on nature;

- integrating the full costs and benefits related to nature in investment decisions;

- enforcing systematic no-net loss approaches within investment operations, applying the mitigation hierarchy (always favouring avoidance of any impacts first) and biodiversity-offset schemes and/or ecosystem restoration good practices;

- proactively supporting nature-positive business models that will significantly contribute to biodiversity and ecosystem benefits while generating sustainable incomes and creating green jobs.

To achieve this important role, strong engagement on these dimensions is required to ensure that current biodiversity and ecosystem degradation trends are reversed. Time to act is limited, and bold commitments followed by concrete actions are needed.

What is the Luxembourg-GLF Finance for Nature Platform?

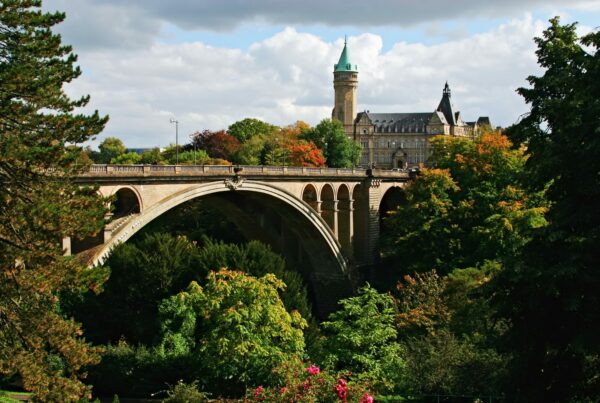

Building on the fruitful co-organisation of the fourth annual GLF Investment Case Symposium in Luxembourg in 2019, an event aiming at sharing good practices of sustainable land use finance with a global audience, the Government of the Grand Duchy of Luxembourg and the Global Landscapes Forum (GLF) have launched the Luxembourg-GLF Finance for Nature Platform. This Platform aims to mainstream and accelerate sustainable finance with a specific focus on nature-based solutions, climate change, ecosystem restoration, and biodiversity. The collaboration is initially planned for the period 2021‒2024.

The Platform is designed to address the needs of communities in low- and middle-income countries. In doing so, the partnership will help achieve the United Nations’ Sustainable Development Goals, along with targets of the three Rio conventions (CBD, UNCCD and UNFCCC).

Activities under this platform would include preparation of relevant knowledge management and communications initiatives, designing knowledge products and capacity building, organizing events, and engaging with key Luxembourg organizations to help them increase their engagement in NbS financing. The partners also aim to build a community of practice that will support the mainstreaming of investments in NbS, with innovations shared from Luxembourg to the world.

The next GLF Investment Case Symposium, part of the Luxembourg-GLF Finance for Nature Platform, will be held from 5-7 November 2021 in Glasgow, alongside the United Nations Climate Change Conference (COP26).

What is the Global Landscapes Forum?

The Global Landscapes Forum (GLF) is the world’s largest knowledge-led platform on integrated land use, dedicated to achieving the Sustainable Development Goals and Paris Climate Agreement. The Forum takes a holistic approach to create sustainable landscapes that are productive, prosperous, equitable and resilient and considers five cohesive themes: food and livelihoods, landscape restoration, rights, finance and measuring progress. It is led by the Center for International Forestry Research (CIFOR), in collaboration with its co-founders UNEP and the World Bank and Charter Members.

* Article author: The Global Landscapes Forum