Instruments to help you navigate the sustainable finance journey

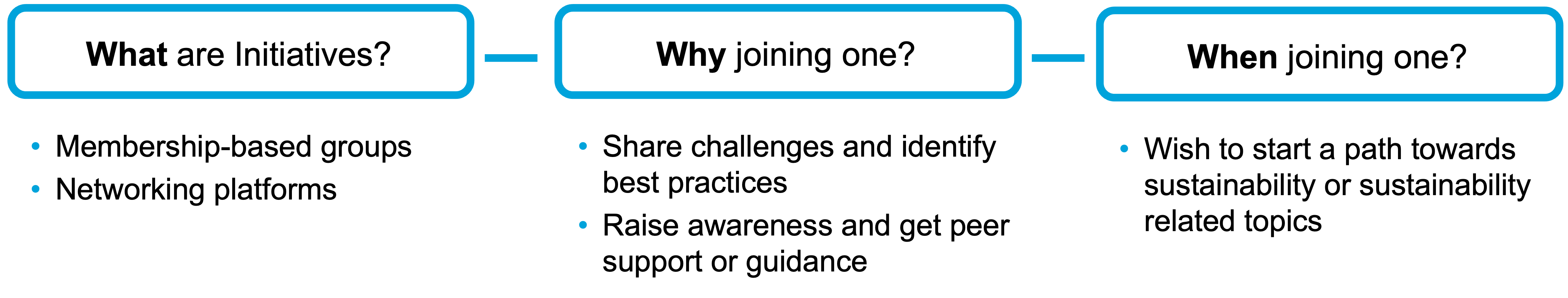

Take Action – Initiatives

Find an Initiative

The table below will help you navigate the main Initiatives relevant for financial actors. You can filter by Target or Region or search by Keyword. To ensure the full usability of this page, we recommend you to access it through your laptop and make the browser window full screen.

| wdt_ID | Name | Description | Targets | Themes | Region | Members/AUM |

|---|---|---|---|---|---|---|

| 1 | Asia Investor Group on Climate Change (AIGCC) | Create awareness and encourage action regarding the risks and opportunities associated with climate change and net-zero investing. | Asset Managers, Asset Owners, Service Providers | Net-zero Emission | East Asia, South East & Pacific | 76/ $35.8 trillion |

| 2 | Banking Environment Initiative (BEi) | Lead the banking industry in directing capital towards sustainable economic development. | Banks | Biodiversity, Environment, Net-zero Emission | Global | 9 / NA |

| 3 | Business for Nature (BfN) | Bring together all types of organizations calling for governments to adopt policies to reverse nature loss. | Companies, Financial Institutions, Organisations | Biodiversity, Environment | Global | NA |

| 4 | Capitals Coalition (CC) | Redefine capitals approach to empower decisions making, understanding how success is underpinned by natural, social and human capital. | Academia, Companies, Financial Institutions, Organisations, States | Accounting, Biodiversity, Natural Capital | Global | 400+ / NA |

| 5 | Ceres Investor Network | Transform the economy to build a sustainable future & advance investment practices, corporate engagement, and policy solutions. | Asset Managers, Asset Owners | Energy, Net-zero Emission, Reporting, Water | North America | 200 / $47 trillion |

| 6 | Climate Action 100+ (CA 100+) | Focus on +160 companies that are critical to the net-zero emissions transition to ensure they take actions on climate change. | Asset Managers, Asset Owners, Service Providers | Net-zero Emission | Global | 700 / $68 trillion |

| 7 | Mainstreaming Climate in Financial Institutions (CA in FI) | Make climate change a core component of financial institutions' businesses, working on best practices and innovative approaches. | Central Banks, Development Banks, Financial Institutions | Climate risk, Net-zero Emission | Global | 53 / NA |

| 8 | Climate Bonds Initiative (CBI) | Promote investment in climate change solutions or a rapid transition to a climate resilient economy. Developed the Climate Bonds Standard. | Banks, Bond Issuers, Securities Markets, Service Providers, Stock Exchanges | Energy, Environment, Infrastructure, Net-zero Emission, Reporting | Global | 106 / NA |

| 9 | Climate Safe Lending Network (CSL) | Accelerate the decarbonization of the banking sector, providing a peer-learning space to implement climate finance strategies. | Academia, Asset Owners, Banks | Net-zero Emission | Europe, North America | NA |

| 10 | ClimateWise (CW) | Respond to the risks and opportunities of climate change - facilitated by the Cambridge Institute for Sustainability Leadership (CISL). | Insurances | Climate Risk | Global | 37 / NA |

Disclaimer – Please note that LSFI is a not-for-profit association aiming to support the development of sustainable finance. LSFI’s website’s content aims to serve this purpose by giving information that would help its audience better understand and navigate sustainable finance’s concepts and stakeholders. This work does not aim to be fully comprehensive or to promote one organisation over another. It is also by no means to be considered as financial or legal advice. We also invite our audience to help us improve our content by submitting their comments using the “Feedback” button below.