Data platforms to help you navigate your sustainable finance journey.

Resource Hub – Data Platforms

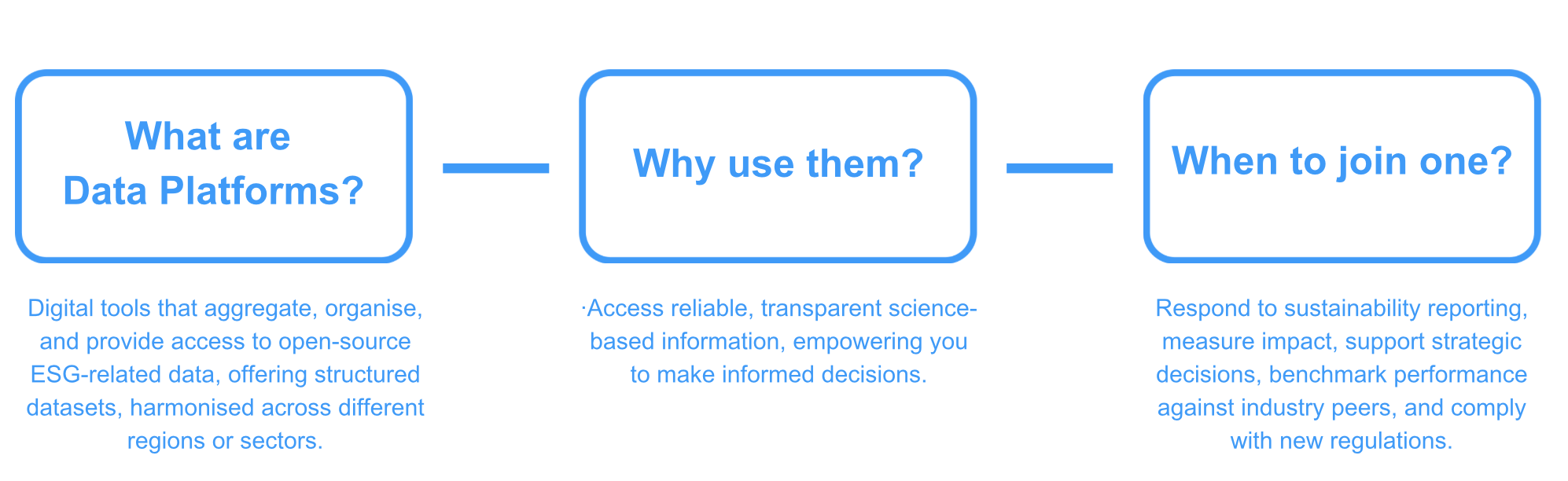

Explore the key data platforms that provide science-based, comparable, and harmonised open-source datasets. The image below provides an overview of these, explaining what they are, as well as when and why to use them. In the table, you can filter by platform type, target audience, themes, and industries or sectors, or search directly using keywords. For the best experience, we recommend accessing this page on a laptop and viewing it in full-screen mode.

Find a Data Platform

| wdt_ID | Name | Description | Tool types | Targets | Themes | Industries/Sectors |

|---|---|---|---|---|---|---|

| 1 | Climate Impact Explorer (CIE) | Provide time and spatial evolution of identified climate impact indicators (can be used for stress-testing). Show how the severity of climate change impacts will increase over time in continents, countries and provinces at different levels of warming, sta | Scenario Analysis, Stress Testing | Academia, Companies, Financial Institutions, Policy Makers | Climate, Risk, Scenario Analysis | Agriculture, Cross-sectoral |

| 2 | Global Entrepreneurship Monitor (GEM) | Conduct survey-based research to assess the state of entrepreneurship and entrepreneurial ecosystems worldwide. | Database, Knowledge | Investors, Venture Capital | Community, Education | Cross-sectoral |

| 3 | Adaptation, Biodiversity and Carbon Mapping Tool (ABC-Map) | Assess the environmental impact of National Policies and Plans (NDC, NAPs, etc) and investments in the agriculture, forestry and other land use (AFOLU) sector. | Maps, Scenario Analysis, Target Setting | Academia, Companies, Institutions | Adaptation, Biodiversity, Transition | Agriculture, Forestry |

| 4 | ACT - Assessing Low Carbon Transition | Assess corporates’ climate strategy against the required low-carbon transition and associated sector-specific decarbonization trajectories. | Company Assessment, Target Setting | Companies, Financial Institutions | Target Setting, Transition | Agriculture, Aluminum, Automotive, Cement, Chemical, Consumer Goods, Cross-sectoral, Glass, Industrial, Oil & Gas, Paper, Real Estate, Steel, Transport, Utility |

| 5 | Excellence in Design for Greater Efficiencies (EDGE) | Identify the most cost-effective ways to reduce the resource intensity of a building to prove the business case for building green and to unlock financial investment. | Knowledge, Maps, Portfolio Assessment | Investors, Mortgages, Real Estate | Energy, Housing, Water | Infrastructure, Real Estate |

| 6 | OPF Atlas | Offer a digital overhaul for the verification and issuance of carbon credits. | Maps | Companies, Financial Institutions | Taxonomy, Transition | Cross-sectoral |

| 7 | Biodiversity Guidance Navigation tool | Guided natural capital self-assessment (biodiversity-inclusive), with interactive questions and supporting resources. Guide users through a biodiversity-inclusive natural capital assessment, following the steps outlined in the Natural Capital Protocol; Fr | Company Assessment | Companies, Financial Institutions | Biodiversity, Natural Capital | Cross-sectoral |

| 8 | Carbon Pricing Dashboard | Provide a map and key statistics on existing and emerging carbon pricing initiatives around the world. | Maps, Knowledge | Companies, Financial Institutions | Transition | Cross-sectoral |

| 9 | Carbon Tracker’s Company profiles | Provide in-depth analysis on the impact of the energy transition on capital markets and the potential investment in high-cost, carbon-intensive fossil fuels. | Company Assessment | Asset Owners, Financial Institutions | Climate, Risk, Transition | Coal, Energy, Oil & Gas |

| 10 | CERISE’s Social Assessment tool (SPI4 and ALINUS) | Assess the implementation of the Universal Standards and benchmark against peers. | Company Assessment | DFIs, Investors | Client Responsibility, Employees Responsibility, Governance, Microfinance, Social | Cross-sectoral |

Disclaimer – Please note that LSFI is a not-for-profit association aiming to support the development of sustainable finance. The content of LSFI’s website aims to serve this purpose by giving information that would help its audience better understand and navigate sustainable finance’s concepts and stakeholders. This work does not aim to be fully comprehensive or to promote one organisation over another. It is also by no means to be considered as financial or legal advice.