What are these instruments?

Collaboration, Guidance, Metrics & Data Collection

A comprehensive selection of what’s available for you.

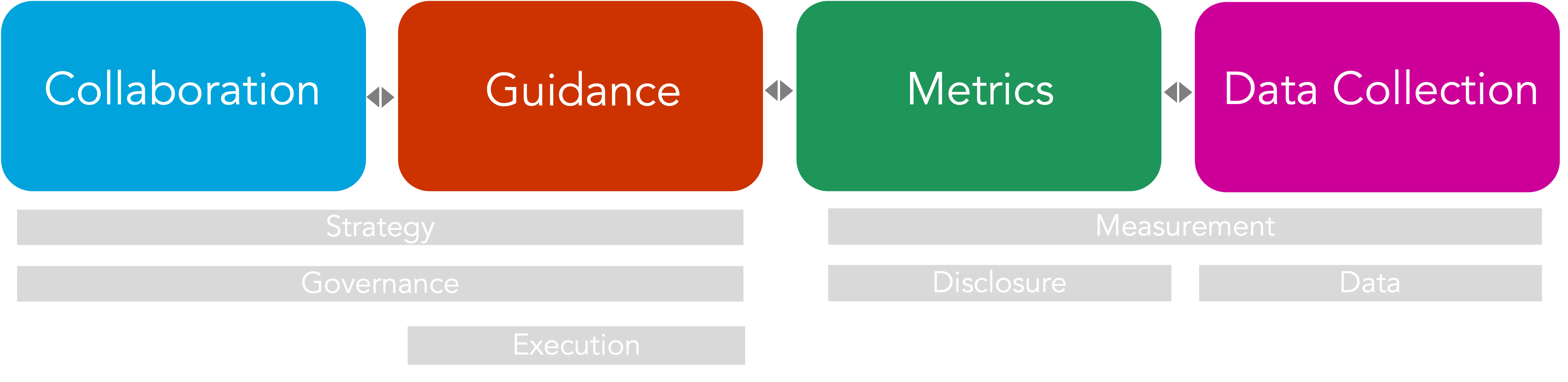

To help financial players navigate the sustainable finance path there are multiple collaboration, guidance and data collection instruments which can guide and facilitate the integration of Environmental, Social and Governance criteria into the business structures and the investment discussions. Complementarily, some of them help understand and measure the impact.

How and when can these instruments be used?

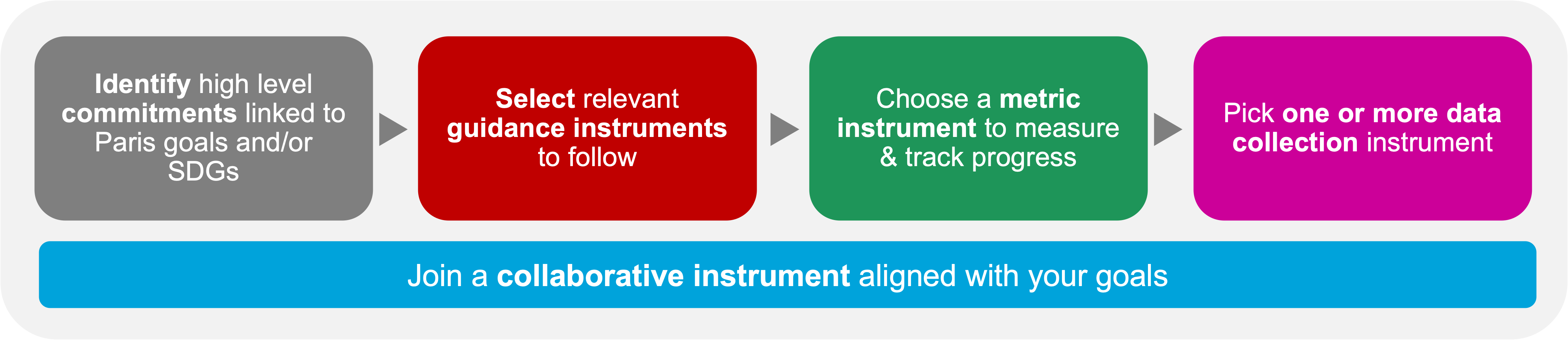

Each of them covers a distinct purpose and objective and, therefore, are used at a different stage of the business process or the investment decision. However, these intruments can be applied simultaneously and are complementary. Financial players might follow and commit to more than one based on their size, strategy or objectives.

When and for which reason to apply them can found at the chart below.

A comprehensive list of these instruments and its function can be found in this section. On the upper menu located at the top of this page, click on the need you wish to cover to access a specific category and be able to navigate through the different options.