The Luxembourg Sustainable Finance Initiative (LSFI), in collaboration with PwC Luxembourg, has conducted the study “Sustainable Finance in Luxembourg – A quantitative and qualitative overview” which assesses the sustainable finance segment in Luxembourg.

Sustainable Finance Study Release

Sustainable Finance in Luxembourg – A quantitative and qualitative overview

About the Study

One of the Luxembourg Sustainable Finance Strategy Pillars and key actions foresees the LSFI to measure the progress of the financial sector within the context of its efforts towards Sustainable Finance. To pursue this objective, the LSFI decided to conduct a study to assess the Sustainable Finance segment in Luxembourg in order to understand where the sector stands, what the key trends are and what strategies towards sustainability are used.

In this regard, the study takes a deep dive into the sustainable finance industry, analysing the main ESG strategies implemented through sectoral analysis and asset classification breakdowns, among other dimensions. It also presents leading sustainable finance investment practices in Luxembourg and describes the current impact assessment framework, aiming to complement other studies and identify gaps in the existing framework so as to determine actions for improvement.

Study's main findings

Analysing the ESG landscape

Attempts to analyse the ESG landscape within Luxembourg’s overall financial services industry are significantly constrained by the lack of publicly available data on the banking and insurance sectors, as well as on the alternative investment sectors (Private Equity, Venture Capital, Real Estate and Infrastructure). At the moment, the investment funds industry remains the only assessable sector within the financial industry. This is because it is currently the only sector with consistent and public ESG data (both historical and current), positioning it as the most common predicate for existing studies on ESG (including the study). The lack of publicly available data can be observed not just in Luxembourg but globally.

ESG qualification

Even though the investment fund sector stands as the only sector for which (paid) data is available, the ESG dimensions and data that are assessed in various studies (including the study) are heavily reliant on the data provider, who typically has sole oversight on how their ESG data is collected and classified.

Luxembourg ESG fund assets

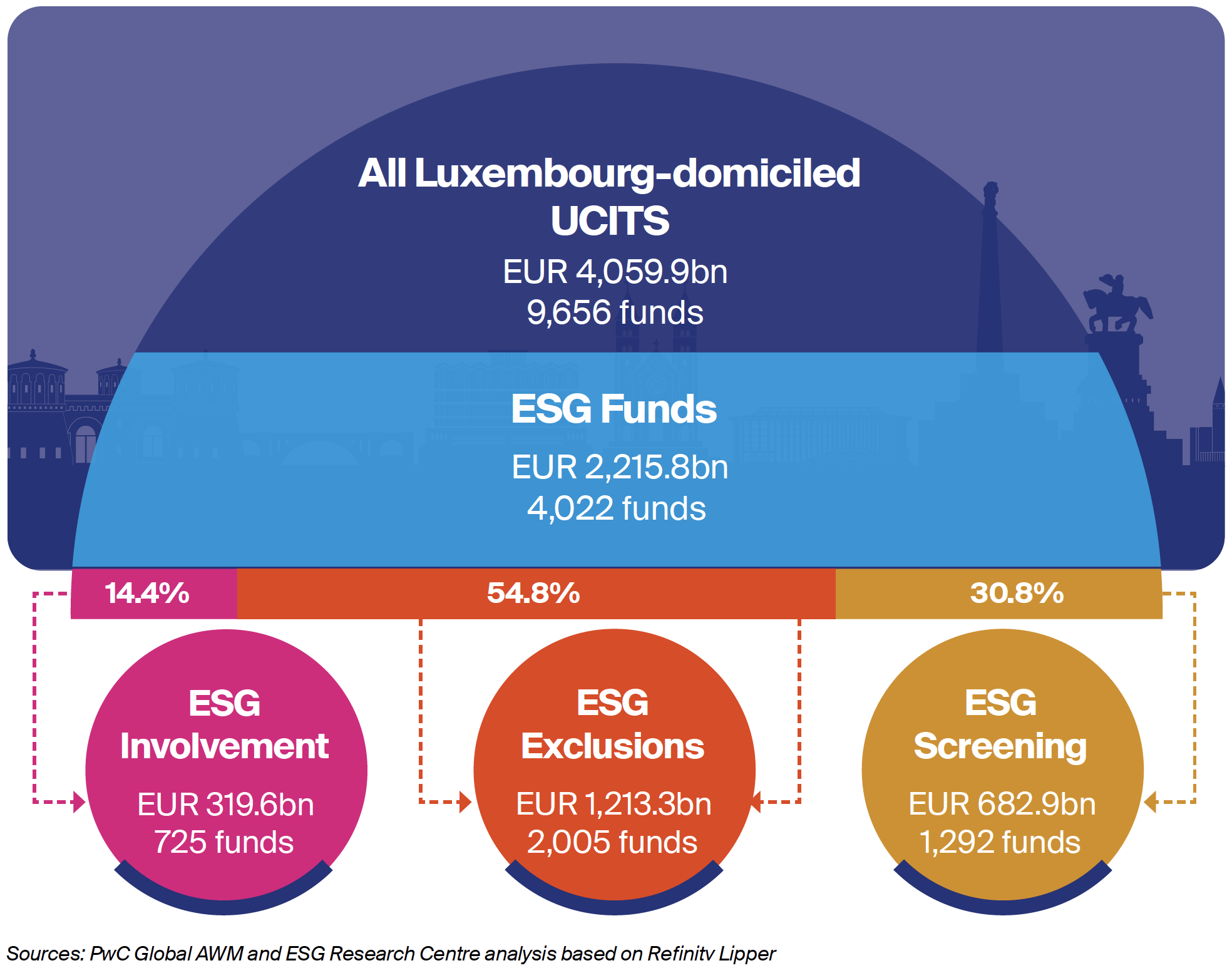

Despite the economic uncertainty and market turmoil observed during the first half of 2022, Luxembourg-domiciled ESG funds registered EUR 2.2tn in total assets at the end of June 2022. This ESG fund AuM represents approximately 54.6% of the country’s overall UCITS fund assets, which surpassed EUR 4.0tn by the same period. In terms of number of funds, ESG funds correspond to 4,022 out of the 9,656 funds in our sample, highlighting the far-reaching extent of sustainability integration within the Luxembourg fund investment framework.

ESG involvement funds sub-strategies

ESG exclusion strategy application

Nearly half of the ESG funds in our sample (2,005 funds) apply ESG Exclusions strategy, accounting for 54.8% of the ESG UCITS assets. Out of these funds, 27% apply up to 2 exclusions while 21% apply up to 3 exclusions — mainly from the weapons, tobacco and fossil energy sectors. The largescale use of this strategy is linked to the exclusion of companies in controversial sectors from their portfolios being the preliminary step for asset managers who are beginning to take a stand towards sustainability.

ESG involvement strategy application

ESG Involvement was the least applied strategy, accounting for only 18% of funds in our sample and 14% of ESG fund assets. Some of these funds in this cluster were also found to implement ESG exclusion, with 66.6% of them excluding at least one sector from their universe of investable assets, and 11% excluding up to 5 sectors.

Asset class allocation

Equity accounted for 47% of total ESG asset allocation in Luxembourg as of end-Q2 2022, making it the most preferred asset class for ESG fund investments in Luxembourg. This preference is catalysed by a growing interest by institutional investors to expand their ESG asset base, the strong draw of retail investors towards the asset type, as well as structural overlaps between the active approach that is generally applied in both equity and ESG fund management. Bonds are the second most predominant asset class for ESG fund allocation, constituting 31% of total Luxembourg-domiciled assets by the end of June 2022.

Sectors allocation

Luxembourg’s ESG investment diversification approach focuses on a plethora of sectors, led by the Software & Services sector holding 9.8% of ESG funds’ AuM. This, in addition to Pharmaceuticals (9.1%) and Capital Goods (8.4%) saw the greatest ESG fund asset allocations by June 2022.

ESG assets geographical focus

55.4% of Luxembourg-domiciled ESG assets are placed in global-focused funds, which allows fund managers to meet clients’ diversification and risk mitigation objectives while providing them with a wide asset coverage. Europe and US represent the next most common regions when it comes to the geographical focus of ESG funds in Luxembourg.

Managers headquarters split

French fund managers have the highest number of ESG funds domiciled in Luxembourg -738 out of the total 4,022. In terms of AuM, however, they are outpaced by US fund managers, who boast more than one-fifth (23%) of Luxembourg’s EUR 2.2tn ESG funds’ AuM.

Active vs passive management

93% of ESG funds’ AuM in Luxembourg is actively managed, hinged on the notion that intentional and proactive ESG integration is preferably executed actively. Nevertheless, despite the lack of industry accepted ESG indices for passive investments, we are seeing a growing attraction towards passive ESG investments by investors who are drawn in by its low costs, reduced risks and diversification benefits. In addition to this, the expanded adoption of the EU Climate Transition benchmarks and EU Paris-aligned benchmark could see a rise in ESG passive investments.

SFDR application

Over 53% of UCITS AuM in Luxembourg is invested in funds adhering to either Article 8 or Article 9 disclosure requirements in compliance with the Sustainable Finance Disclosure Regulation (SFDR). The less stringent nature of Article 8 requirements makes it the predominant category, with 47% of UCITS assets under this classification, while Article 9 constitutes 6%.

Impact measures

The lack of generally accepted, standardised and widely utilised impact measures suggests that it is currently not possible to assess the effective positive impacts of Sustainable Finance investments on the real economy. It also remains to be clarified how the theoretical changes underpinned by Sustainable Finance investments can be best assessed, monitored and verified.

KPIs

To complete the analysis of the applied strategies and have a greater understanding of overall investment ESG approach and investments’ impact, an additional look at the underlying companies and their ESG dimensions – collected in the desired standardised and comparable way mentioned above – should be further explored. In line with this, additional clear and harmonised KPIs on environmental dimensions, social and human rights considerations and governance aspects are much needed to measure and track progress.

ESG funds engagement

Further, there is currently no availability of structured and comparable data on the application of ESG funds’ engagement strategies – a fundamental aspect of which is generally known as active ownership. Engagement is a fundamental leverage that can possibly be applied by financial players to push the transition of the invested companies. This underscores the need for further research/studies as well as significant data collection on ESG funds’ engagement strategies and the applied approaches.

Blended Finance

In developing countries, sustainable growth is still hampered by the perception and presence of numerous risks. In such cases, blended finance can be a useful tool to raise additional funds – specifically private capital, providing financial returns to investors while reducing some of these risks.